Getting Organized To Issue Tax Information To Parents

I’ve been preparing and issuing yearly Child Care Payment totals for parents since 1999 and I have found that it is vital that I keep track of parent payments to assure that parents are issued accurate totals for their tax return.

In 2011, two parents questioned the payment totals that I issued to them (for 2010 childcare payments) and I thought that was impossible, because I was using Quickbooks to keep track of my weekly parent payments.

Moreover, I discovered, that I failed to record several payments in my payment receipt book, which resulted in two payments not being entered into the computer. I praised those parents for doing such a great job on keeping track of their childcare payments and thanked them for bringing the tax error to my attention.

In fact, I was so grateful for the error, because it inspired me to be more diligent about recording payments that I receive from parents.

Tom Copeland writes a great blog for Child Care Providers and I strongly suggest that you check out his blog post titled: A Family Child Care provider asks:Is it income if I don’t report it?

As I was preparing to issue Child Care Payment totals for 2011, I was reminded again of the importance of keeping track of parent payments and how time-consuming the process is.

According to Tom Copeland, “In any situation, however, money you receive from parents for child care is taxable income and must be reported on IRS Form 1040 Schedule C. If you fail to report all of your income there are several ways you can get caught:

* A parent who previously agreed not to claim the child care tax credit may decide later to go ahead and claim the credit when she realizes how much it can be (the maximum is $1,050 for one child).”

Furthermore, be sure to give parents a notice that indicates the following information:

- Your Tax Id number

- The Name and address of your business

- The amount that the parent paid you for childcare services

- The name of the child or children that you cared for

- Your phone number

- It’s also a good idea to add the following words on the Tax Letter Please keep with your “Tax Year” Records

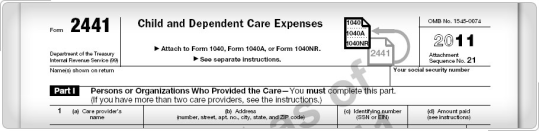

The IRS does not look for any form in particular from you to issue to parents, however, the parent will need the information above to claim a child and dependent tax credit.

My final tip to you is to have a back-up system for keeping track of childcare payments and this includes:

- Creating a back-up file on a flash drive

- Keep a copy of the written payment receipts issued to parents

- Have payments stored in your computerized financial software for easy access

Have you prepared your tax statements or letters to issue to parents for 2011 yet? If so, how was the process for you? I look forward to your comments and tax payment ideas.

With your Child Care Business in Mind,

Shiketa

Are You ready to expand your business? Frustrated with the level that you are on? Check out the Going to Another Level, 21-Day Mastermind e-Club.

You must be logged in to post a comment.